An RCA is a tax deferred savings vehicle that can be used to invest and save for retirement. Ideal for high-income earners such as business owners, incorporated professionals, executives, and athletes, an RCA represents the highest level of retirement program available in Canada. An RCA allows a company to make tax-deductible contributions on behalf of key employees for purposes of retirement to the maximum level allowable.

An RCA is ideally suited for high-income earners ($150,000+) such as business owners, athletes, executives, and incorporated professionals who wish to sustain their standard of living into retirement. The flexibility of the RCA allows it to be adapted to many business and tax strategies. The RCA requires a sponsoring company in order to set it up.

An RCA is often used in the following situations:

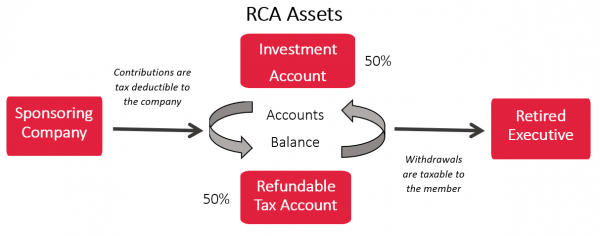

A company establishes an RCA to provide retirement benefits for its employees. Deductible contributions are made from the company into the RCA and are held in trust for the beneficiaries.

The trust is subject to Refundable Tax, as illustrated below:

Each year the company may choose to make contributions on behalf of the members of the plan, who may also be required to contribute to the RCA. 50% of these contributions are made to an RCA Trust investment account. The other 50% is remitted to a refundable tax account (RTA) with Canada Revenue Agency (CRA). Half of net realized investment income is remitted to the RTA on an annual basis. Similarly, the investment account can recover half of net losses to the extent refundable tax has been remitted on realized gains in prior years.

The investment account is managed by plan trustees and directed by the company or the principal plan member. There are few investment rules or restrictions; however, it is recommended that the investments be of a non-distributing nature, as 50% of all dividends, realized capital gains and interest income less expenses must be remitted annually to the RTA.

Upon retirement or a change of employment status the beneficiary will draw from the assets of the RCA Trust. An amount equal to 50% of the distribution from the investment account will be refunded to the investment account from the RTA account after the T3-RCA Tax Return has been completed at the calendar year-end. Withdrawals are flexible and not subject to any restrictions on maximum or minimums. They are however, subject to withholding tax at a rate of 30% if located in Canada. Another benefit at withdrawal is that money contributed at today’s tax rates may be withdrawn in the future at lower rates. This will be dependent on current rates having decreased or the beneficiary moving to a lower tax jurisdiction in Canada, or outside Canada in countries such as the United States or Australia where tax treaties result in lower withholding rates.

Provided there is a change of employment status the member of the RCA may begin withdrawals from their RCA at any age they wish. By the same token, there is no requirement to begin withdrawals at age 71, such as applies to Registered Plans. The assets of the RCA may remain in the Trust Fund throughout the lifetime of the member and may subsequently be used for the benefit of spouses and beneficiaries.

Complete our online RCA Questionnaire or download the PDF. Your GBL representative will prepare a custom RCA quote at no cost within 1-2 business days.

Upon receipt of your RCA quote, please contact your GBL representative who is available for consultation to answer any questions that may arise.

Once the decision has been made to set up an RCA, you will complete our authorization form and return by mail, email, or fax to your GBL representative. Please allow 5-10 business days to receive your RCA documentation for signing.

Your GBL representative is available to assist in the signing process and to answer any last minute questions. Upon final execution of the RCA documents, GBL will submit the plan on behalf of your client to Canada Revenue Agency (CRA).

At this time the RCA account can be opened and the RCA can be funded. You will identify investment objectives so your assets are invested according to your preferences. For details regarding matching contributions to CRA click here, or contact your GBL representative.

"*" indicates required fields